How Insurers Can Improve Customer Experience and Operational Efficiency with Dynamic Customer Engagement (DCE)

To keep up with rising expectations for customer experience, insurance companies are working to establish the infrastructure necessary for personalized interactions, increased engagement, and additional value-added services.

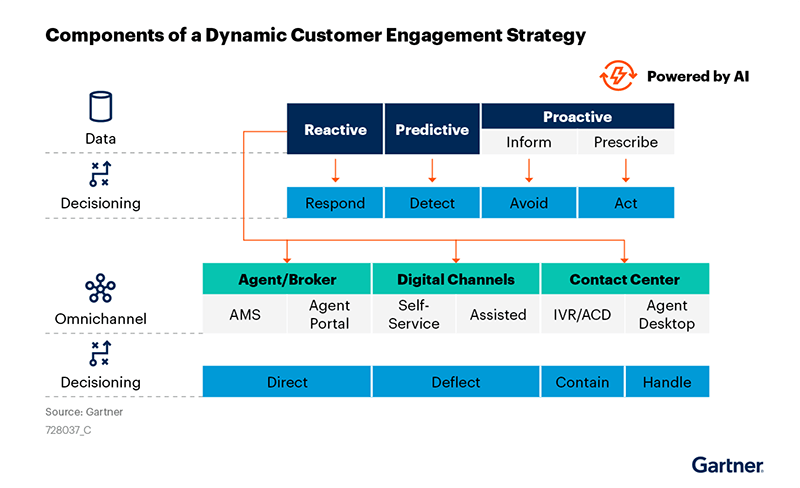

To achieve this, CIOs must put in place strategies for engaging customers in dynamic ways to enhance the customer's intelligence and improve decision making in real-time across all channels of interaction.

Additionally, by using dynamic customer engagement, insurers can also identify potential issues or concerns before they become major problems, which can help to reduce claims and improve overall operational efficiency.

According to Gartner, 46% of insurance leaders reported that CX was a top technology-led initiative.

What are key components of a Dynamic Customer Engagement Strategy?

A dynamic customer engagement strategy typically includes several key components, including:

1. Data and analytics: Insurers must be able to collect, store, and analyze data about their customers in order to understand their needs and preferences. This data can come from a variety of sources, including customer interactions, social media, and other online behavior

2. Personalization: Once insurers have a better understanding of their customers, they can use this information to personalize their interactions and communications with each individual. This can include things like personalized emails, text messages, or even phone calls.

3. Omni-channel communication: A dynamic customer engagement strategy should include multiple channels for communication, including phone, email, text, and social media. Customers should be able to reach out to the insurer through their preferred channel and get the same level of service.

4. Continuous monitoring and improvement: A dynamic customer engagement strategy should include continuous monitoring and improvement to ensure that the insurer is meeting the needs of their customers and making changes as necessary. This can include things like customer feedback surveys and other forms of customer research.

5. Automation and Artificial Intelligence: Automation and AI can help insurers manage customer interactions and communication at scale. Tasks such as account management, sales, customer service, and claim management can be automated or assisted by AI.

6. Integration with other systems: Insurers should have a dynamic customer engagement strategy that integrates with other systems, such as CRM, Marketing Automation, Business Intelligence, predictive modeling and similar platforms. This will enable insurers to have a comprehensive view of customers for better service and experience.

What are Consumers’ Engagement Priorities in Insurance?

Consumers have several engagement priorities when it comes to insurance, including:

1. Convenience: Consumers want to be able to access and manage their insurance policies easily and quickly. This may include being able to make payments, file claims, and view policy information online or through a mobile app.

2. Transparency: Consumers want to understand their insurance policies and how they work. This may include clear explanations of coverage, limits, and exclusions, as well as easy-to-understand policy documents.

3. Personalization: Consumers want their insurance policies to be tailored to their specific needs and preferences. They also want the insurance companies to understand their individual needs and preferences and be able to provide recommendations and services accordingly.

4. Accessibility: Consumers want to be able to reach their insurance company easily and quickly when they need assistance, whether it is via phone, email, chat, or social media. They also appreciate having more options to choose from, such as online chat, virtual agent, or other digital channels.

5. Responsiveness: Consumers expect their insurance company to respond quickly and efficiently to their needs. They want their claims to be handled in a timely and fair manner, and for their questions and concerns to be answered quickly and accurately.

6. Proactivity: Consumers appreciate when insurance companies proactively reach out to them with relevant information, such as reminders of when coverage is due to renew, alerts for policy changes, or other tailored communication.

7. Availability of digital tools and services: Consumers are becoming increasingly reliant on digital technologies and expect their insurers to provide digital tools and services that enable them to easily manage their insurance needs, such as video consultations, virtual claims management, and tracking of claims in real-time.

How to build Customer Intelligence for Hyper Personalizing Content and Interactions?

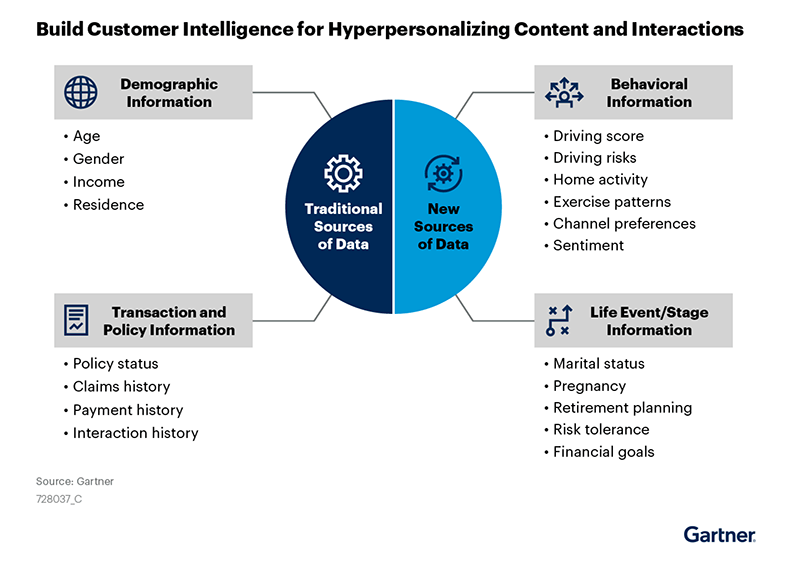

Building customer intelligence for hyper-personalizing content and interactions involves several key steps, including:

1. Data Collection: Insurers must collect data about their customers from a variety of sources, including customer interactions, social media, and other online behavior. This data should include demographic information, as well as information about the customer's needs and preferences.

2. Data Analysisn: Insurers must then use analytics and data mining techniques to analyze this data and understand their customers' needs, preferences, and behavior. This may include things like creating customer segments, identifying customer pain points, and tracking customer engagement metrics.

3. Data Warehousing and CRM: Insurers should store and manage the data in a centralized location for ease of access and analysis, as well as to be able to use it for customer interactions and personalization. Having a comprehensive CRM system in place can also be beneficial for tracking and managing customer interactions over time.

4. Personalization Engine: Once insurers have a good understanding of their customers, they can use this information to create personalized content and interactions. This may include things like targeted email campaigns, personalized product recommendations, and personalized customer service interactions.

5. Continuous Monitoring and Improvement: Insurers should continuously monitor and improve their customer intelligence and personalization efforts. This may include tracking customer engagement metrics, conducting customer feedback surveys, and making changes as necessary to improve the customer experience.

6. AI and Machine Learning: By using AI and machine learning algorithms, insurers can improve their ability to analyze and understand customer data and create more accurate and personalized interactions. It can also provide real-time insights and suggestions for customer interactions.

7. Data Security and Privacy: As a customer’s data is sensitive and private, it is important for insurers to ensure that their data is properly secured and that they are in compliance with relevant data privacy regulations.

According to the 2022 Gartner CIO and Technology Executive Survey, approximately 44% of insurers increased their investment in TX in 2022 compared to the previous year. Initiatives around improving CX and employee experience, user experience and multi-experience will lay the foundation for DCE.

Why has the road to customer centricity been difficult for insurers?

The road to customer centricity has been difficult for insurers for a variety of reasons, including:

1. Data Silos: Many insurers have data silos which makes it difficult to collect and access customer data in a comprehensive and centralized way, making it difficult to gain a complete understanding of customers and personalize interactions.

2. Complex Products: Insurance products can be complex and difficult for customers to understand, which can make it difficult for insurers to communicate effectively with customers and provide relevant and personalized recommendations.

3. Legacy Systems: Many insurers have legacy systems and processes that can be difficult to change, making it hard to implement new technologies and strategies for improving the customer experience.

4. Regulatory Compliance: Insurance is a highly regulated industry, and insurers must comply with a variety of regulations when it comes to data privacy, data security, and other issues. This can make it difficult to implement new technologies and strategies that involve customer data.

5. Resistance to Change: Many insurers have a culture of stability and consistency, and may be resistant to change, particularly when it comes to changing the way they interact with customers and the way they do business.

6. Lack of Investment: Implementing a customer-centric approach can require significant investment in new technologies and resources, which can be difficult for some insurers to justify in the short term, especially if they are focused on short-term financial performance.

7. Difficulty in measuring success: It can be difficult for insurers to measure the success of a customer-centric approach and the ROI on the investment. Identifying key performance indicators and effectively measuring progress can be challenging.

Espire provides insurers with a comprehensive range of digital offerings, which are designed to improve the operational efficiency of systems and lower the cost of acquisition and service policies. We also help brands adopt an agile digital transformation approach by leveraging analytics and BI, customer communications management etc. to improve overall customer experience and increase customer loyalty.